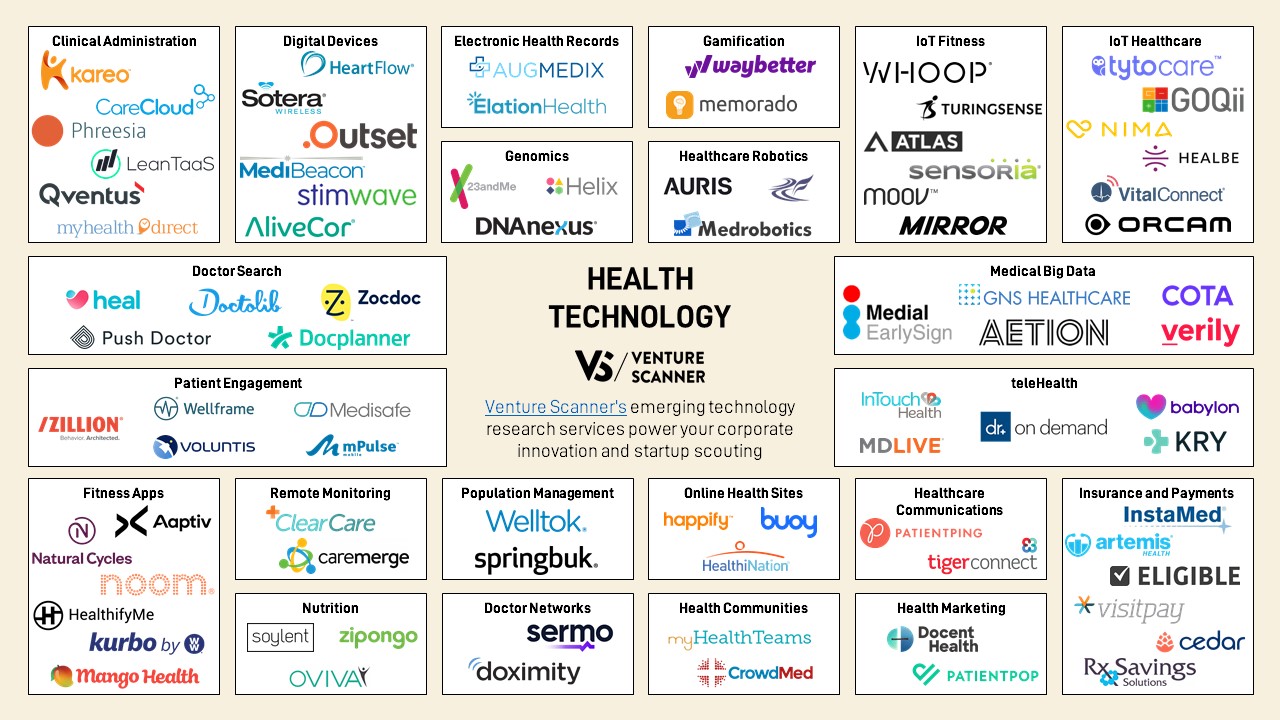

Healthcare has been ‘discovered’ recently as a recession-proof and insanely profitable sector, so new investor money is pouring into healthtech startups: in H1 2020 some $5.4 Billion of venture funding backed 214 digital health deals[i] (source: Rock Health). Eleven of those deals were $100M+ mega rounds, and that’s on top of 381 companies funded last year, and 383 deals the year before, and 367 deals the year before that, et cetera.

One can predict there’s going to be massive M&A consolidation happening soon in the HealthTech sector. So how do you position a healthtech company for strategic M&A buyer interest and maximum valuation?

Here’s one example of how we did it.

TL;DR

- Our client was a 14-year-old software product developer emerging from an aborted M&A deal; our job was re-position them for broader (strategic) investor interest and higher valuation;

- After uncovering their database of 22 million healthcare records, we re-positioned the company away from their software product to align instead with the exploding trends in data science and predictive analytics;

- We wiped their entire website and re-messaged both it and outbound communications with a focus on “predictive analytics for healthcare,” and optimized their on-page SEO for key search terms around ‘healthcare data trends’ and other high-value keywords;

- We partnered with an external digital sales team to fill the prospect/customer pipeline;

- We aligned with lobbyists in Washington DC and offered company executives to media/press for commentary around new healthcare legislation.

Results: Our client went from a broken deal to a strategic-valuation exit to Carlyle Group private equity in just 10 months.

Full Story

Our client’s founders were practicing physicians wanting to exit their business after 16 years of operations. They had developed software for on-boarding new medical patients & injury information, and tracking what therapies were received and recording their ultimate outcomes measurements (i.e. how well did the therapies help patients to recover). The company had a recent acquisition offer fall apart during due diligence, and our job was to re-position them for broader (strategic) investor interest and higher valuation.

Valuation-Optimization Strategy

In our analysis of the client’s products and customers, we found they were reasonably successful in revenue-generating products, but the market for buyers of patient-intake software companies was thin.

Interestingly, the company was very rich in industry influence and healthcare data: they had developed a risk-analysis algorithm to help physicians price their services appropriately for reimbursement from Medicare and private insurance companies; and the company founders were contributors to nearly 100 peer-reviewed articles published in medical journals.

Along the way, the company website had also become a nexus for information helpful to the medical insurance industry. Most importantly, we found their database of patient-provided intake surveys held more than 22 million user-consented records of therapies and associated effectiveness from patients throughout the entire United States. Physicians and insurance companies could use the data to correlate specific injuries against patient profiles, geographic regions, specific medical groups, and other related data to predict accurate rehabilitation therapies and associated costs.

The light bulb flashed on: the strategic valuation opportunity lay in the data. For better M&A attractiveness and optimal valuation, we needed to re-position this company from being an on-boarding software product to being a healthcare data analytics company.

Implementation

A key success factor to our implementation was separating the customer/sales process messaging from the new investor messaging. We wiped the company website clean of any product-level messages and aligned it instead to resonate with, and be discoverable by, acquirers looking for leaders in the burgeoning areas of data science, data analytics, and healthtech. Specifically, we re-positioned the company as a leader in “predictive data analytics for healthcare” – backed by its database of 22 million patient data records. The website was optimized for SEO for searches related to ‘healthcare trends’ and ‘healthcare data’ and other high-value keywords.

To elevate the company executives as visible industry thought-leaders, we partnered with an influential healthcare lobbyist group in Washington DC and offered up company executives to press/media for commentary on upcoming healthcare legislation and insurance industry regulations. We amplified credibility by highlighting the many peer-reviewed medical journal articles co-authored by the company founders.

On the revenue side, instead of nurturing sales via the website, we worked with an external digital sales team to implement a series of targeted email lead-gen campaigns to not only replace any sales lost at the website, but to even further bulk up the pipeline of interested prospects and sales hand-offs

Results + Lessons

Our client attracted the interest of Carlyle Group private equity and was acquired just 10 months after our first day of work.

What we learned was that we didn’t have to invest in any actual changes to the product or operations (other than the digital sales effort); the entire turn-around was accomplished with a good understanding of the valuation drivers in the marketplace and some clever marketing messages and re-positioning. The experience was also a reminder that revenue creates financial value at exit, that may not be the only asset that potential buyers care about. Strategic valuation often hides elsewhere.

We also learned, once again, to look at industry trends and seize on them before the floodgates open. Often, the window for acquisition is short and the key is to position yourself as a leader in the space faster than other similar companies so that you, and only you, are the ones to be acquired with a significant strategic valuation bump.

XROCKET.io is a new breed of sell-side advisory that helps entrepreneurs position and optimize for acquisition well before they hire an M&A banker. If you know a company that is considering M&A in the 1-2 year future, reach out to me directly at m.addison@xrocket.io.

SOURCE: [i] https://rockhealth.com/reports/2020-midyear-digital-health-market-update-unprecedented-funding-in-an-unprecedented-time/?mc_cid=ded6ce0665&mc_eid=9cbd2c85b1